Altair’s (NASDAQ:ALTR) growth in 2023 hasn’t deteriorated to the extent that I earlier thought it might, helping to support the company’s share price in recent months. There are also early signs that demand may be accelerating, or at least stabilizing, which is impressive given the macro environment and the performance of a number of peers. Altair appears to be reducing the pace of its investments, which should lead to an improvement in profit margins going forward, particularly if growth reaccelerates.

The company’s valuation remains elevated though, particularly in light of Altair’s modest growth and lack of profitability. As a result, any company-specific issues or broader economic weakness could result in a sharp share price correction.

Market

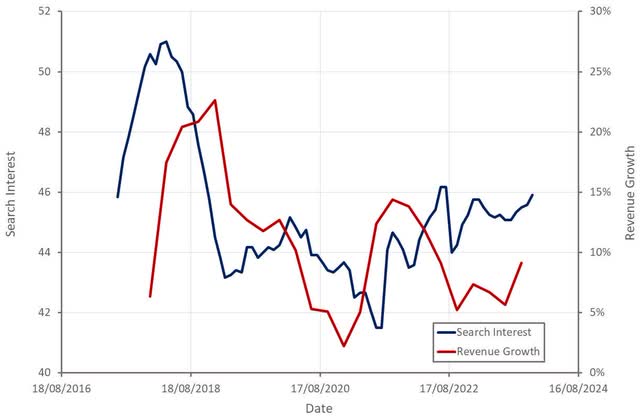

While Altair’s performance has been fairly robust in 2023, the company continues to face a challenging macro environment. High-interest rates are impacting economic activity in a number of areas, and the manufacturing sector is still adjusting to the post-pandemic norm. In addition, Europe and China are both facing economic weakness and rising geopolitical tensions are contributing to uncertainty. Despite macro headwinds, Altair remains optimistic, with the company expecting to generate growth and gain market share in 2024. This should be supported by Altair’s end-market exposure. Automotive and aerospace accounted for roughly 39% of Altair’s 2022 billings, and so far, these industries are holding up relatively well.

Figure 1: Manufacturing Survey Data (source: Created by author using data from The Federal Reserve)

ANSYS (ANSS) reported relatively soft growth in the third quarter, which was partially attributed to its prospect vetting process failing to meet US Department of Commerce requirements. Altair stated that it has not been affected as it has been following Department of Commerce requirements all along. The suggestion here seems to be that Altair’s China business has been lagging due to the company’s stringent vetting process. Altair’s China business is reportedly small compared to some other players in the market.

Altair

Altair offers three major products:

- Altair HyperWorks – design and simulation platform

- Altair RapidMiner – data analytics and AI platform

- Altair HPCWorks – high-performance computing and cloud platform

While Altair’s background is more in simulation and high-performance computing, the company is increasingly focused on data analytics and leveraging AI across its product portfolio.

Altair continues to release solutions across its portfolio which aim to provide:

- Improved user experience (to support broader adoption of its software)

- Modern APIs

- Tighter integrations between products

- Frictionless high-performance computing

- Increased computation speeds

The growing use of AI and digital twins in manufacturing is a large opportunity, which Altair is pursuing aggressively. Twin Activate is the foundation of Altair’s digital twin solution. The recent acquisition of OmniV for its requirements management solution also helps to round out Altair’s digital twin solution. OmniV’s software helps to formalize the development, integration, and use of models to inform decision-making. OmniV is vendor-agnostic and can connect to various enterprise data stores and verification and validation methods. Altair is seeing increased digital twin demand from customers for both design and in-service applications.

Altair also recently added to its structural optimization portfolio with the acquisition of OmniQuest. OmniQuest’s structural analysis and optimization software is used in the automotive sector to develop lightweight and efficient designs.

Within HPC, Altair offers software to facilitate and optimize the use of HPC infrastructure for compute-intensive tasks. Altair’s HPC solutions also enable workloads to be easily moved from on-prem data centers to the cloud and between different cloud providers. This enables customers to perform computation in the lowest cost location. Altair expects HPC to continue expanding, with a shift in focus towards cloud/hybrid infrastructure as well as the edge.

From a sales perspective, Altair is increasing its focus on verticals to help drive the adoption of its software. Altair has also introduced data science expertise into the sales organization. This should help to drive cross-selling of Altair’s data analytics solutions and help the company maximize the value of its RapidMiner acquisition.

Financial Analysis

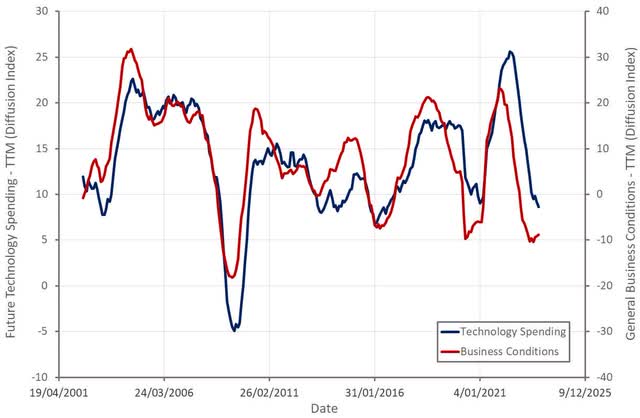

Altair’s revenue increased by 12.3% YoY in the third quarter to 134 million USD. Software product revenue grew 14.5% YoY on a constant currency basis and now contributes 88.9% of total revenue. Some of this strength can likely be attributed to the acquisition of RapidMiner in September 2023. While it is difficult to be certain based on publicly available information, I estimate that Altair’s organic third-quarter growth rate (adjusted for the easier comparable period in 2022) was in the mid-single digits.

The automotive, aerospace and technology verticals were areas of strength in the third quarter. Softening automotive demand and UAW strikes could become an issue for Altair at some point, but so far, the company has seen no impact. Expansion within Altair’s renewal base, including the cross-sell of data analytics and AI, was also a growth driver.

Figure 2: Altair Revenue Growth (source: Created by author using data from Altair)

In general macro data continues to look weak, and evidence of an economy-wide reacceleration appears to be fading. Despite this, there are some signs that Altair’s growth rate may have bottomed, although this is difficult to tell as Altair’s growth is lumpy.

Altair is guiding to approximately 172 million USD in revenue in the fourth quarter, a 7% YoY increase. While this is lower than third-quarter growth, much of this appears to be due to differences in 2022 comparable periods. If Altair meets guidance, it will support the notion that growth is picking up or has at least stabilized.

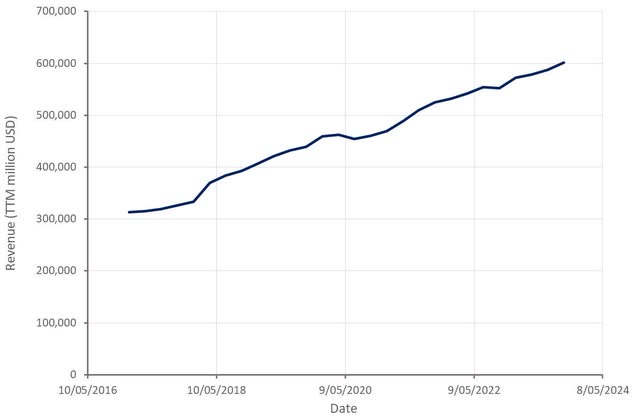

Figure 3: Altair Revenue Growth and Search Interest (source: Created by author using data from Google Trends and Altair)

Altair’s gross profit margins are generally improving over time, which is related to the growth of high-margin software product revenue. This is expected to continue being a tailwind going forward but given the extent to which software revenue already dominates the business, the benefit will only be modest.

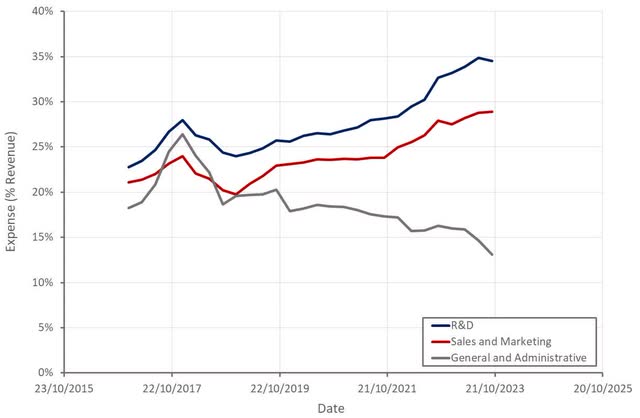

Improvements in gross profit margins have been more than offset by operating expense increases in recent years though as Altair has invested aggressively in R&D and sales and marketing. Altair’s investments now appear to be moderating and growth is leading to operating leverage. In addition, Altair has been realizing cost synergies from its RapidMiner acquisition ahead of expectations.

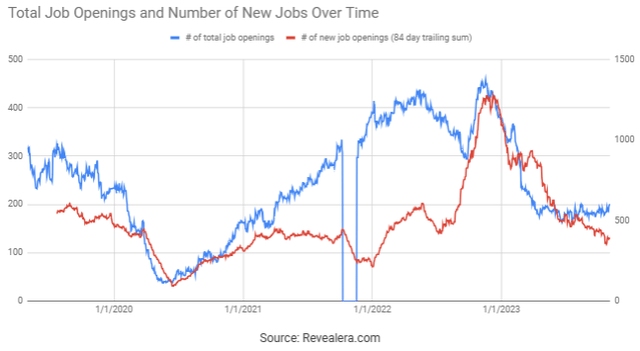

Given Altair’s modest hiring in recent months it would be reasonable to expect operating profit margins to improve in coming quarters, particularly if growth remains solid. Assuming growth remains solid, operating profit margins could be in the mid to low single-digit range next year.

Figure 4: Altair Operating Expenses (source: Created by author using data from Altair) Figure 5: Altair Job Openings (source: Revealera.com)

Valuation

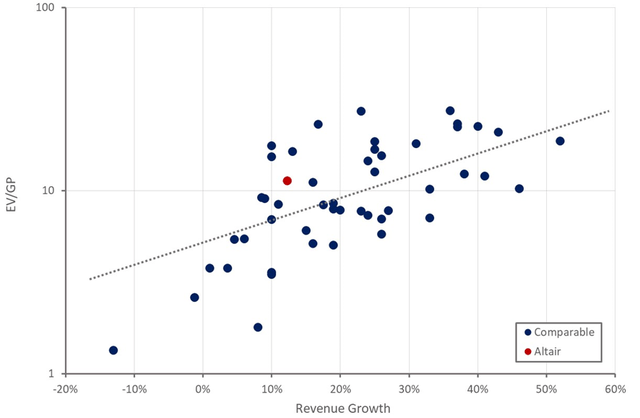

Based on its current growth rate and lack of profitability, Altair looks overvalued relative to similar companies. While Altair’s growth is likely currently depressed, it hasn’t been impacted to the same extent as many high-growth software companies. It is therefore also likely that when economic conditions improve, Altair’s growth will not reaccelerate to the same extent as many other software companies.

Demand headwinds are likely to carry over into 2024 and improvements in profitability will likely only be modest. As a result, Altair’s stock probably has limited upside from current levels and could fall significantly if Altair stumbles or macro conditions weaken.

Figure 6: Altair Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here