Warren Buffett opened the books for the September quarter of his conglomerate Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) and presented a ~41% growth in operating income. Interestingly, despite strong and growing earnings, Buffett slowed the pace of share buybacks sharply, buying back only $1.1 worth of Berkshire stock during the trailing 3 months. The decision to reduce share buybacks is surprising, in my opinion, because not only remains the environment for deals lackluster, but also has Berkshire’s cash pile hit a record $157 billion. In this article I take a detailed look at Berkshire’s Q3 capital allocation. But the main takeaway is that Buffett continues to favor investment in U.S. Treasuries over equities.

For reference, Berkshire Hathaway has performed in line with the broader U.S. stock market YTD. Since the start of the year, shares of BRK.A are up about 13%, one percentage point below the 14% achieved by the S&P 500 (SP500)

Seeking Alpha

Berkshire Hathaway Reports A Strong Q3 2023

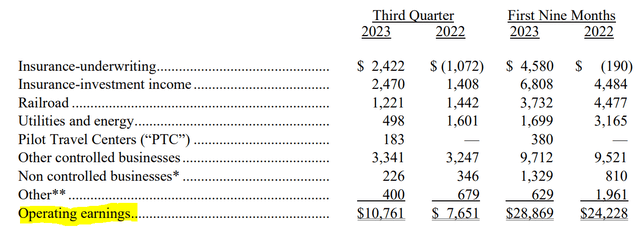

Berkshire Hathaway reported a strong set of Q3 2023 results: From the period spanning June through end of September, Warren Buffett’s conglomerate accumulated $10.8 billion in operating earnings, up about 41% YoY compared to the $7.7 billion achieved for the same period one year earlier. Notably, for the trailing nine months, operating earnings are up about 20% YoY, to $28.9 billion, suggesting that Berkshire’s earnings momentum is accelerating in 2H vs. the 1H 2023.

Taking a segment perspective, Berkshire’s Q3 results were supported by surprisingly strong performance from Geico. The insurance business, which suffered multiple periods of consecutive quarters of losses leading up to 2023, achieved a remarkable turnaround by generating $2.2 billion in operating earnings. This positive result can likely be attributed to higher average premiums earned, reduced advertising expenses, and lower claim frequencies. In that context, Buffett has previously expressed his expectation for the insurance sector to perform robustly despite macro headwinds, citing its relatively low correlation with economic business activity. On the other hand, Berkshire Hathaway’s businesses that are more exposed to cyclical trends reported lower earnings vs. 2022: BNSF’s operating income decreased from $1.44 billion to $1.22 billion. Meanwhile, the utility division’s earnings dropped from $775 million to $416 million.

Berkshire Q3 reporting

Annualizing Berkshire’s Q3 operating earnings and applying a 21% statutory tax rate, adjusted net income available for distribution can be estimated at approximately $34 billion.

On A GAAP reporting basis, Berkshire reported a substantial investment loss of $24.1 billion in the third quarter, primarily attributable to the conglomerate’s stake in Apple (AAPL), which dropped about 12% in value since the beginning of June. That said, Berkshire bolded the following note in the earnings release, urging investors to look beyond meaningless fluctuations in value within Berkshire’s securities portfolio:

The amount of investment gains/losses in any given quarter is usually meaningless and delivers figures for net earnings (losses) per share that can be extremely misleading to investors who have little or no knowledge of accounting rules.

To highlight Berkshire’s point relating to the meaninglessness of “paper gains/ losses”, I point out that only two quarters ago, in Q1 2023, Berkshire’s investment gain totaled $27.4 billion.

The Most Interesting Takeaway

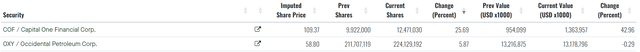

Buffett’s Berkshire reported a strong set of Q3 results. But the most interesting takeaway relating to the earnings report, in my opinion, relates to Buffett’s capital allocation decision. Despite strong and growing earnings, as well as sufficient cash to afford buybacks, Buffett declined to repurchase a material amount of BRK shares during the September quarter. In fact, the pace of buybacks in Q3 slowed significantly versus the 1H of 2023. During the September quarter, Berkshire only repurchased about $1.1 billion of its own sock, compared to $5.9 billion repurchased in the first six months of the year. The slowdown in share buybacks is even more surprising considering that Buffett continues to avoid larger deals, as well as investing in public-listed equity securities. While we do not know the Q3 purchases yet, in Q2 Buffett only added to minor positions in Capital One (COF) and Occidental Petroleum (OXY). I expect a similarity muted activity in Q3 (insights will be revealed in on the 15th of November).

Fintel

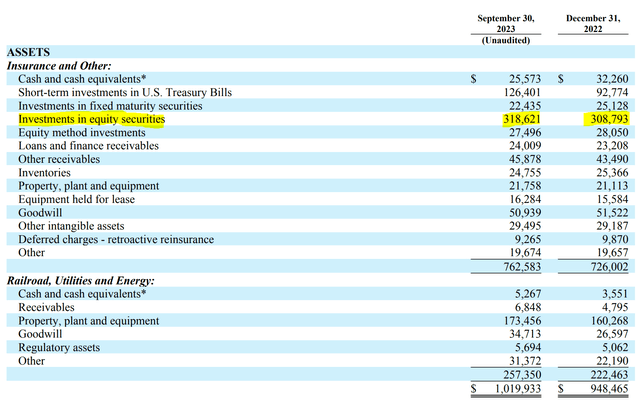

And compared to December 2022, Berkshire’s investment position in equity securities is up only about $10 billion, compared to a broader expansion of the conglomerate’s asset size of approximately $72 billion. With that said, Berkshire’s cash position as of Q3 2023 has grown to a historic record of approximately $157 billion.

Berkshire Q3 reporting – balance sheet

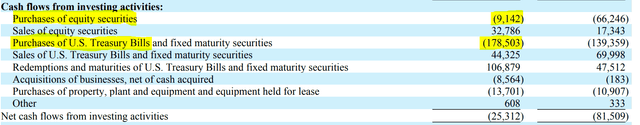

Taking an even closer look to Buffett’s capital allocation decisions, the statement of cash flow is telling: For the trailing 9 months, Buffett only invested about $9.1 billion in equities, while selling $32.8 billion worth of stock ($23.7 billion of net sales). With this, Warren Buffett’s Berkshire Hathaway continues its trend of reducing holdings in publicly traded companies, offloading over $5 billion in net exposure during the third quarter. This ongoing trend has now extended for four consecutive quarters. In the same period one year earlier, the equity investments totalled $66 billion, versus divestments of only $17 billion ($48.9 billion of net purchases).

Meanwhile, trailing nine months 2023 investments in U.S. Treasuries jumped to $178.5 billion, compared to $139 billion for the same period in 2022.

Berkshire Q3 reporting – cash flow

The takeaway that investors should get when looking at Berkshire’s balance sheet and cash flow statement is that Buffett continues to avoid equities, and favor investments in fixed income securities. This decision is in line with my own portfolio strategy, as I have previously argued that it is time to “dump” dividend stocks and pile into Treasuries instead, because the Treasuries’ yield tops the yield of most popular dividend stocks. Moreover, in another article, I also discussed the potential for highly attractive, equity-like capital gains in Treasuries, arguing:

… as yields are likely to drop over the next 12-24 months on fading inflation and a dovish Fed shift, Treasurys are poised to celebrate a bull market — likely rewarding investors with equity-like capital gains. Expecting a 150 – 175 basis point drop in yields, I estimate that 10-year Treasurys may gain 11% to 15%, while the 20+ year Treasurys may appreciate by as much as 23% to 30%.

Conclusion

In the third quarter, Berkshire Hathaway reported a robust 41% growth in operating income, with earnings growing to $10.8 billion. Notably, Berkshire’s Q3 earnings growth signals an uptick in momentum versus the first half of 2023.

Despite a strong performance for Berkshire in Q3, it is notable that Warren Buffett’s has decided to significantly reduce share buybacks vs Q2 and Q1. This slowdown in share buybacks is particularly surprising given Berkshire’s substantial cash reserves, which reached a record $157 billion by the end of Q3. In that context, Buffett’s preference for fixed income investments over equities, as reflected in the cash flow statement, is aligned with my own view about how to navigate one’s portfolio through the ongoing macro uncertainties: Equities out, Treasuries in.

With Buffett continuing to make very smart, and prudent capital allocation decision, according to my judgement, Berkshire stock remains a “Buy”.

Read the full article here