Enbridge is a solid infrastructure play

I expect a significant upside over the next six months for Canadian-dollars-denominated Enbridge Series R (TSX:ENB.PR.T:CA) and US-dollars-denominated Series 5 (TSX:ENB.PF.V:CA) (OTCPK:EBGEF).

One of the largest global infrastructure companies, Enbridge’s business consists of four major segments: Liquids Pipelines, Gas Transmission & Midstream, Gas Distribution and Storage, and Renewable Power Generation. Diversification between multiple segments results in a stable business model and lower operational and geographic risks.

46% of the company’s revenues are generated in the US, with the remaining 54% coming from Canada. At the same time, 54% of the company’s PP&E is allocated in the United States and the remaining 44% in Canada. This indicates that Canadian assets provide a higher return on the capital invested.

In addition to diversification, the company’s low-risk profile is ensured through long-term contracts for assets and services and the high quality of its customer base. This allows Enbridge to achieve relatively low debt costs, which is very important given high inflation and higher-for-longer interest rates.

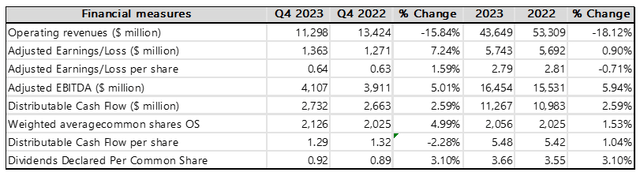

Solid Q4 and annual 2023 results

Enbridge Q4, 2023 Report

Despite the drop in Operating Revenues year-over-year in Q4, 2023 and full 2023, the company reported increases in Adjusted Earnings, Adjusted EBITDA, and Distributable Cash Flow. The decrease in revenues resulted primarily from a much lower contribution from Energy Sales operations than in previous years. The company generated $19 billion from this segment in 2023, which is approximately $10.2 billion less than in the previous year.

Even though this segment’s share of the company’s revenues is very high, its contribution to the bottom line, Adjusted EBITDA, and Distributable Cash Flow is minimal. Actually, the weaker revenue from Energy Services had a positive effect on the overall performance, as it resulted in a $37 million loss in 2023, compared to a loss of $417 million in 2022 and a loss of $313 million in 2021.

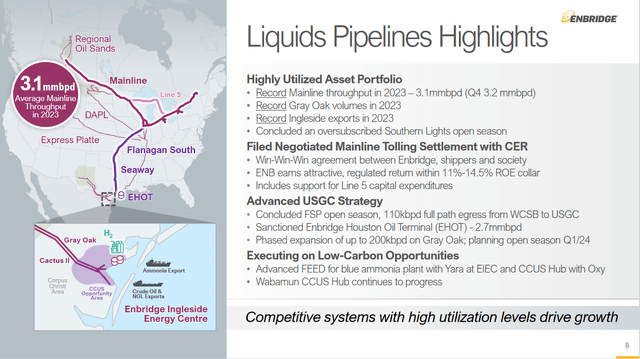

The most important for the bottom line in 2023 was an outstanding performance of the segment that provides the largest contribution to the earnings – Liquids Pipelines. According to the company’s presentation, 2023 was a record year for the segment. Moreover, Enbridge management remains optimistic about the long-term outlook and believes that by the end of 2026, Canada’s oil production will outgrow the export capacity of the currently available pipelines.

Enbridge Q4, 2023 Presentation

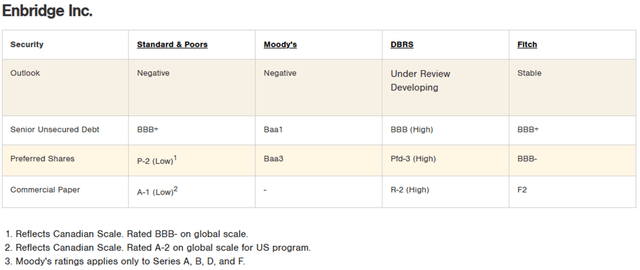

Strong balance sheet

The strength of the company’s balance sheet relies on the high credibility of its clients and long-term contracts for assets and services that are mostly inflation-adjusted. More than 90% of the company’s debt is fixed rate.

Enbridge is BBB+ (or equivalent) rated. In 2023, the company achieved a better-than-target (4.5x to 5.0x) Net Debt to EBITDA ratio of 4.1x. In addition to a solid amount of Cash on the Balance Sheet (which increased year over year), it has $17 billion of available credit on credit facilities.

Enbridge, corporate website

Dividends are safe and sound

Enbridge is one of the Canadian “dividend aristocrats.” For 29 years in a row, the company has increased its dividends. A diversified business model, strong balance sheet, focus on utility-like growth, and high standards applied to M&A indicate management’s commitment to dividend payments. The company achieved a financial close for the US gas utilities acquisition and is not likely to issue a sizable amount of new shares in the near term.

Moreover, the dividend payout target range of 60% to 70% of distributable cash flow represents a large safety buffer. In addition, the fact that the majority of the company’s contracts include inflation-adjusted pricing allows us to expect long-term dividend growth. I notice that over the last 29 years the cumulative annual growth for the common dividends was approximately 9.7%.

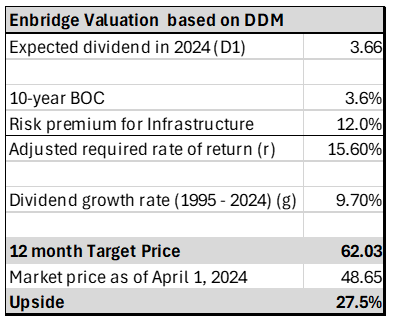

Enbridge common shares valuation

Since Enbridge has a long track record of growing dividends, to value the company, I use Dividend Discount Model (DDM). For the 12-month target price calculation, I assume a $3.66 annual dividend for 2024; I use a 9.7% dividend growth rate based on the annual cumulative dividend growth for the last 29 years (since the company started increasing its dividends). For the Adjusted required rate of return I use a sum of the Bank of Canada 10-year bonds yield and risk premium for infrastructure companies, resulting in 15.6%.

The DDM valuation results in the target price of $62.03 per share, which represents a 27.5% upside to the current market price of the Enbridge common shares in CAD.

Author analysis

The major risks for Enbridge common and preferred shares

Even though Enbridge is an infrastructure company with a low-risk business model, it could face various risks, including operating risks and service interruptions. These risks could result in business disruption, capacity reduction, and increased repair and maintenance costs due to natural disasters, accidents, equipment breakdown or failure, and lower-than-expected operating capacity and efficiency.

As capacity utilization is a critical factor in the company’s performance, a decrease in capacity utilization could affect the valuations of the common and preferred shares. This could be caused by lower-than-expected energy demand, regulatory restrictions, maintenance and operational incidents, and increased competition.

For many companies that grow through M&As, unsuccessful acquisitions represent another major risk factor. Acquisitions are capital-intensive and often result in below-average return on capital due to overoptimistic assumptions. However, Enbridge’s management declared a focused and disciplined approach to M&As.

Regulatory changes also represent a significant risk for infrastructure companies and regulated utilities. Many of the companies’ operations are regulated, and failure to obtain required government approvals for new and existing projects would undermine business and financial results.

Interest rate risk could result in material financial losses due to an increase in the cost of capital and difficulties in raising funds cost-effectively. As an infrastructure company with strong balance sheet, Enbridge has access to capital at competitive costs. Moreover, less than 10% of the company’s interest payments in 2024 are based on variable interest rates.

Investment case for preferred shares

I expect a significant upside over the next six months for Canadian dollars denominated Enbridge Series R ((ENB.PR.T:CA)) and US dollars denominated Series 5 ((ENB.PF.V:CA)) (EBGEF).

The current interest rate environment presents a unique opportunity for investing in selected preferred shares. Recently reported, Canadian inflation was lower than expected. This, coupled with the March 20 Fed decision on interest rates and Chair Powell’s dovish press conference, suggested that interest rates in the US and Canada will decrease in the second half of the year and likely continue their downward movement in 2025.

The market expected aggressive rate cuts to start in March, which led to a period of superior performance for preferred shares between October 2023 and January 2024. At the same time, the delay in easing opened a wider window of opportunity to invest in the preferred shares, with 5-year yields resetting before the middle of the year. It also caused a slower-than-expected price increase for the recently reset preferred shares.

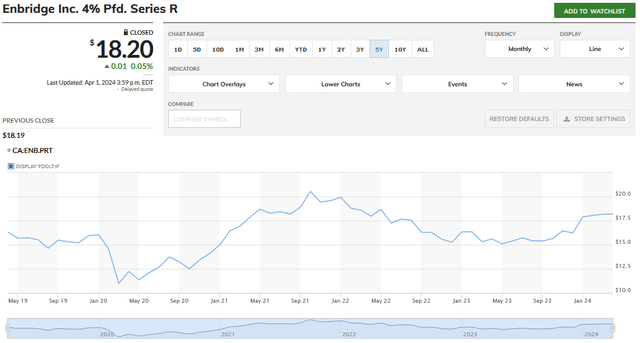

Enbridge preferred Series R, ENB.PR.T:CA, dividend reset is coming soon

MarketWatch

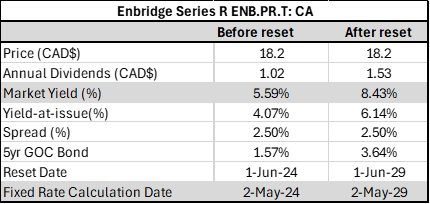

According to the company’s prospectus, the Series R, ENB.PR.T:CA shares were issued at CAD 25 with the dividend calculated based on the sum of the 5-year Government of Canada Bond plus a 2.5% spread. In June 2019, the dividends were set at $1.02 per share (all the figures are in CAD unless otherwise stated), implying a yield-to-issue of 4.07%. This means the 5-year GOC rate was 1.57% at that time.

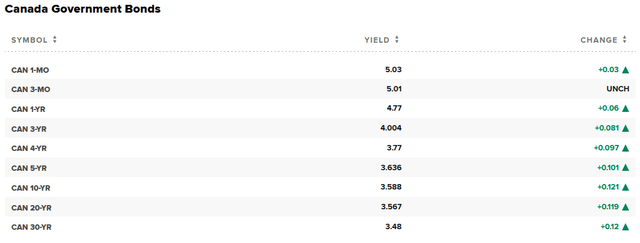

As of closing on April 1, 2024, the yield of 5-year GOC was 3.636%, which is approximately 2.1% higher than at the previous reset five years ago.

CNBC, Canada Government Bonds

Assuming the current 5-year GOC yield at the time of the reset, the yield-at-issue price would be 6.14%. Purchased at the current price of Canadian $18.20, Series R, ENB.PR.T: CA would yield 8.43% per year for the next five years, providing a 50.6% increase in annual dividend payments. The future decrease in interest rates should also result in a tailwind to the price of the preferred shares.

Author analysis

Risks to the Enbridge preferred Series R, ENB.PR.T:CA

The reset’s timing carries both upside and downside risks. The downside risk could materialize if the yield of the 5-year GOC bonds significantly decreases at the reset, limiting the investment’s return over the next five years.

On the contrary, a higher 5-year GOC bond yield would increase the profitability of this investment. I also notice that the upward price adjustment for this type of preferred shares starts about one month before the calculation date for the new 5-year period, and the share price goes up by approximately 6% to 10% plus. As of April 1, there is one month until the new yield calculation date on May 2, 2024.

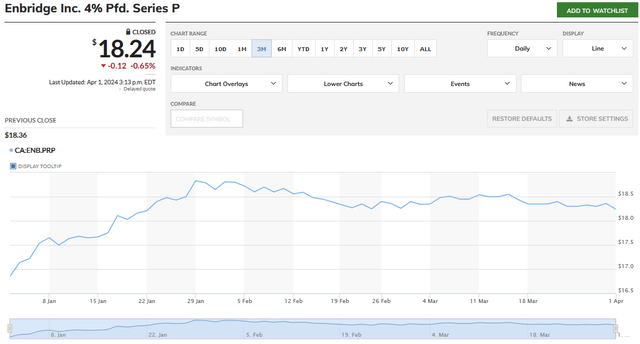

Peers that recently went through a similar reset strongly performed one month before the calculation date

The share prices for these preferred shares started to increase about one month before the fixed rate calculation date. The yield reset for Enbridge preferred shares Series P (ENB.PR.P:CA) was on January 30, 2024. One month before the reset, the share price increased by around 12.2%.

MarketWatch

Algonquin Power preferred shares Series A (AQN.PR.A: CA) had a yield reset on December 4, 2023. One month prior to the reset, the share price went up by approximately 13.6%.

MarketWatch

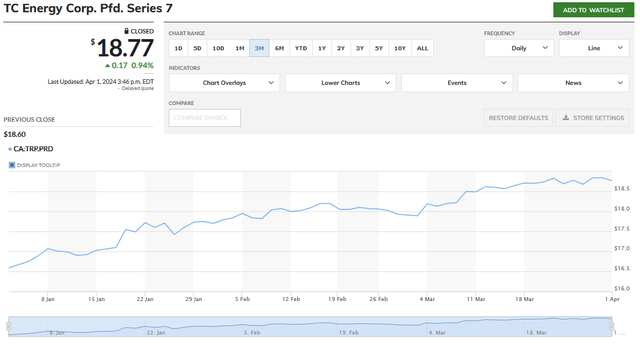

Also, as I wrote earlier, TC Energy preferred shares Series 7 (TRP.PR.D: CA) reset on March 31, 2024. Since the beginning of March, the price of this preferred share has increased by about 6%. This limited growth could be explained by changes in assumptions related to the interest rate cuts.

MarketWatch

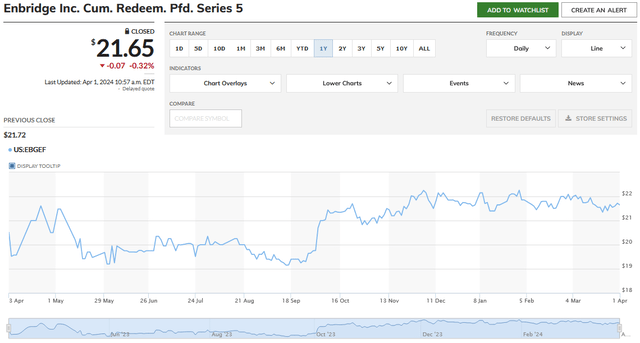

Enbridge US$ preferred Series 5 ENB.PF.V (EBGEF) has more upside

MarketWatch

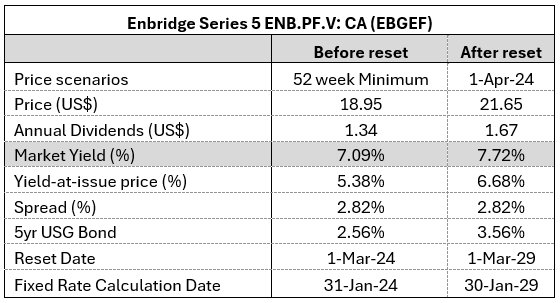

Enbridge preferred shares Series 5, ENB.PF.V (EBGEF), pay dividends in US$, and the yield is attractive: 7.72%. After the yield reset on January 31, 2024, the dividends increased from US $1.34 to US$1.67, or approximately 24.3%. It seems that the shares’ valuation has not fully priced in significantly higher dividends. This becomes clear after comparing the current yield of Series 5 ENB.PF.V (EBGEF) with the yield based on the 52-week Minimum price.

Author analysis

The current yield is higher than the yield based on the 52-week minimum price, which tells us that the preferred shares have a significant upside that is likely to be realized when the Fed starts lowering rates. To reach the same yield based on the new dividends, the current price should be around $23.60, or approximately 9% higher.

Conclusion

The unique macroeconomic situation in Canada and the US, where high interest rates are likely to start their multiyear decrease in the second half of 2024, provides investors with an opportunity to lock into a dividend yield that will significantly increase on May 2, 2024, and remain at this level for the next five years. This can be done through Canadian Enbridge preferred shares Series R ENB.PR.T:CA. Based on the current market price and 5-year GOC Bond yield after May 2, these preferred shares are likely to yield around 8.43%.

At the same time, expectations of aggressive monetary policy easing in the US have not been realized. In October 2023, the market expected the Fed to cut interest rates 5 times beginning March 2024. These expectations changed to three rate cuts starting June 2024. The result of the less aggressive view on the rate cuts has been a downward pressure on preferred shares that had already gone through a reset of their 5-year yield. It seems likely that lower interest rates will unlock the upside of the Enbridge preferred shares Series 5 EBGEF (ENB.PF.V:CA). These preferred shares currently yield 7.72%.

My DDM analysis shows that Enbridge common shares, in addition to the current yield of 7.45%, have a significant 12-month upside of 27.5%. My company analysis and major risks assessment point to a relatively low risk of investing in Enbridge preferred and common shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here