Introduction

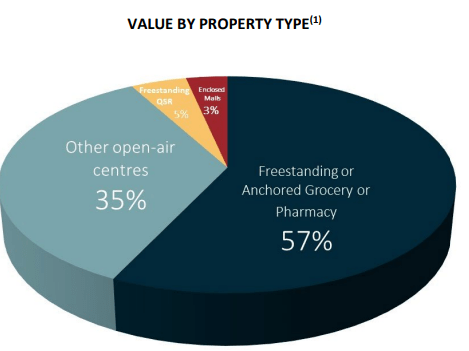

I like real estate assets and I have been interested in commercial REITs for quite a while now. Of course, not all commercial REITs were created equal and I preferred to focus on the subset that focuses on “essential goods.” Plaza Retail REIT (OTC:PAZRF) (TSX:PLZ.UN:CA) performed pretty well during the COVID pandemic as it has been focusing on pharmacy and grocery store focused real estate assets.

Plaza Investor Relations

I used to have a pretty substantial position in the REIT’s debentures as I was able to secure a position at a steep discount to par during the COVID pandemic, but unfortunately (or maybe, fortunately), the REIT repaid those debentures when they matured. I currently have no position in any security issued by Plaza Retail REIT but I have been mulling over taking a long position in the common stock of the REIT and that’s why I’m keeping tabs on its financial performance.

A closer look at the impact of increasing interest rates on the AFFO

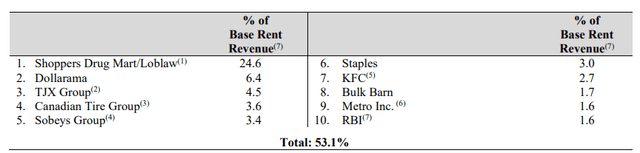

Plaza Retail REIT has a relatively defensive profile as its largest tenant is the Loblaw Group which operates superstores and the Shoppers Drug Mart pharmacies. Other tenants like Dollarama and Canadian Tire should perform pretty well as well. In general, I like the REIT’s tenant mix.

Plaza Investor Relations

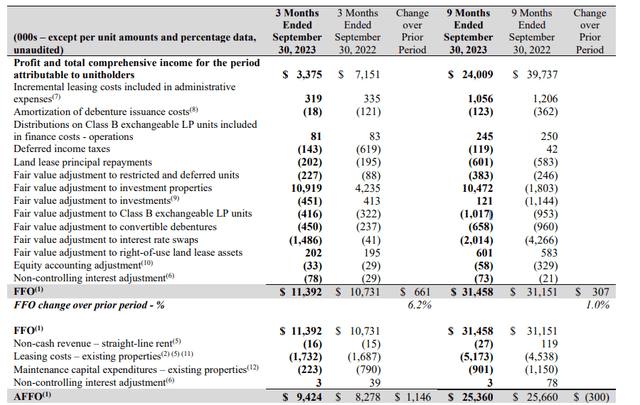

When analyzing a REIT, the FFO and AFFO are the most important metrics to look at. The FFO calculation actually starts with the net profit of C$3.4M but then removes (and adds) all irrelevant and relevant factors to derive the Funds Flow from Operations.

As you can see below, the FFO during the third quarter of 2023 was approximately C$11.4M, resulting in a C$9.4M AFFO after deducting C$1.7M in quarterly lease costs and C$0.2M in maintenance capex.

Plaza Investor Relations

This means the FFO/share came in at C$0.10 while the AFFO was approximately C$0.085 per share, based on an average weighted share count of 111.5 million shares. That’s an important result as it means the current distribution of C$0.02333 per share per month is fully covered by the incoming AFFO. The quarterly dividend is approximately C$0.07/share and considering the AFFO was C$0.085 per share in the third quarter, the payout ratio was approximately 82%. That’s a substantial improvement compared to the first few quarters of the year.

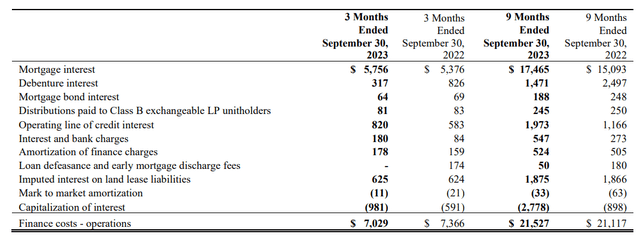

It’s interesting to see the REIT has been able to keep its interest expenses under control: The total finance costs are even lower than a year ago, and this is likely mainly due to the capital raise which was completed at the end of the first quarter. The company raised a net amount of C$38M at a price of C$4.68 per unit, and in hindsight, that was an excellent move to take advantage of the high share price.

Plaza Investor Relations

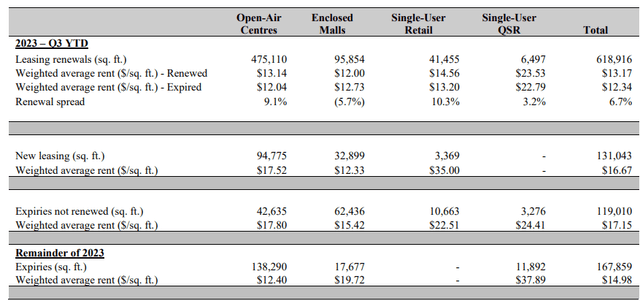

Fortunately, Plaza has been able to push through some rent hikes and in the first nine months of the year, the REIT was able to increase the rent on its renewals by approximately 6.7%.

Plaza Investor Relations

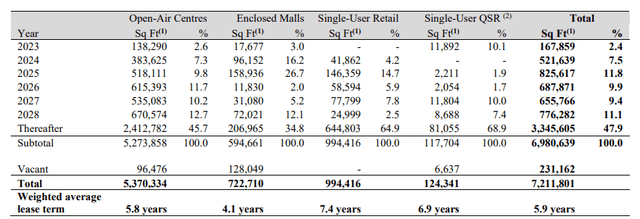

Looking at the upcoming renewals, the REIT will have to renew leases to the tune of 7.5% of its total square footage. Although rent renewals were pretty strong in 2023, it will be interesting to see the type of renewal spreads it can generate in 2024.

Plaza Investor Relations

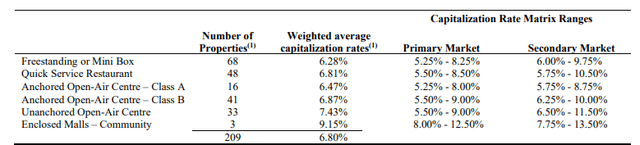

The REIT ended the third quarter with a book value of C$5.04 per share which means the stock is currently trading at a discount of approximately 30% vs. that book value. The book value is based on a total valuation of C$1.05B for the income producing properties and considering the Q3 NOI increased to in excess of C$18M, the properties are currently valued at a multiple of approximately 14-15 times the net operating income. Looking at the weighted capitalization rates, the properties are valued at an average cap rate of 6.8% and in its accompanying footnotes, Plaza discloses that every 0.25% increase in the capitalization rates would have a negative impact on the book value of C$39.5M.

Plaza Investor Relations

This means that even if you would use a 75 bp increase in the capitalization rate (which would increase to 7.55%), the total book value of the assets would decrease by just C$120M or C$1.08 per share. Even in that scenario, the current share price would still represent a discount to the fair value.

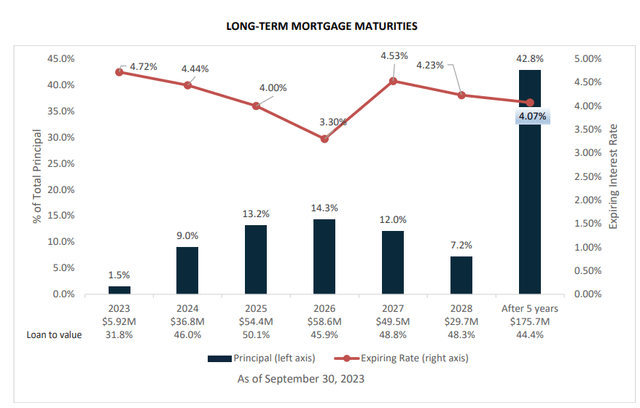

Of course, the increasing interest rates on the financial markets will for sure add pressure to the earnings result, but keep in mind that between now and the end of next year, Plaza only has to refinance approximately C$91M at an average cost of debt of 4.20%.

Plaza Investor Relations

Increasing the average cost of debt to 6.5%, the AFFO/share would only be hit by just C$0.02 per share per year. That’s manageable as the REIT will likely also be able to increase the rent across the portfolio. In fact, hiking the rent by 1.5% in 2024 and 2025 will be sufficient to cover the entire impact of potential interest rate hikes.

Investment thesis

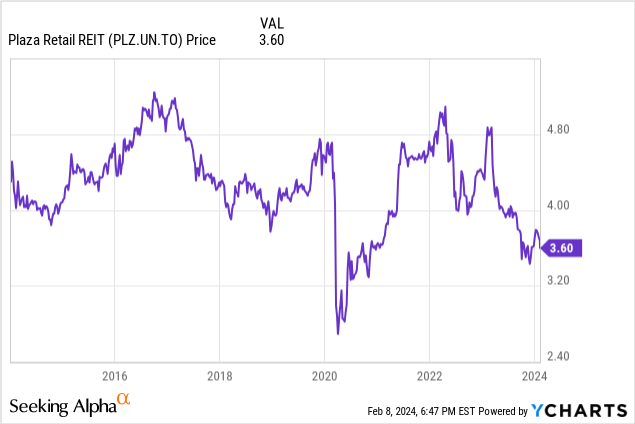

I have been relatively slow to decide whether or not Plaza Retail REIT deserves a spot in my portfolio and patience is a virtue. The stock lost another few percent since my previous article while its Q3 performance was pretty strong and definitely very satisfying. I will be looking for confirmation in the Q4 2023 results and hopefully the REIT will provide guidance for 2024. Unless there are any negative surprises, I expect the AFFO per share to stabilize which means the dividend will still be well-covered. And that makes the 7.8% dividend yield very appealing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here